(1)ChinaBond Index Analysis

ChinaBond Composite Index tracking general performance of bond market wentup today. The net price index excluding interest revenue rose by 0.0046%; andthe total return index including interest reinvested revenue rose by 0.0154%.In addition, the average yield to maturity was 4.5095%. The average marketcapitalization yield was 4.5184%. And the market value weighted duration was3.8429.

(2)Bond Market Performance:

Rate Securities

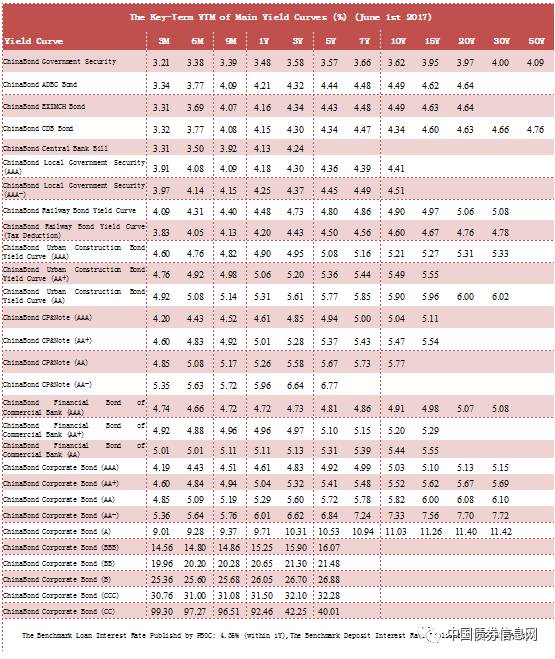

Generally speaking, the yields of Treasury Bonds and Policy Bank Bonds experienceda slight fluctuation overall. The auction outcome of EXIMBC Bonds on 3/5/10Y inthe morning and that of CDB Bonds on 3/5/10Y in the afternoon all descendedmoderately. By the end of day, the yields of Treasury Bonds went up slightly by1BP as a whole; the yields for CDB, ADBC and EXIMBC Bonds presented mixedpattern within 2BPs.

To be more specific, the yield of Treasury Bonds (3Y) stood at 3.58%according to the transaction of 170008; 5Y Bonds kept stable at 3.57% resultedfrom the transaction of 170007; referring to the quotation and transaction of170006, the yield for 7Y Bonds went upwards by 1BP to 3.66%, and notably, theyield for Treasury Bonds (10Y) stood at 3.62% caused by the quotation andtransaction of 170010.

Similarly, the yields of CDB bonds showed mixed pattern, waving a littleoverall. The yield of 3Y Bonds decreased by 1BP to 4.30% because of thetransaction of 170205; 5Y Bonds dropped by 1BP to 4.34% resulted from the quotationand transaction of 170206; referring to the transaction of 170210, the yieldfor 10Y Bonds stood at 4.34%.

Moreover, the yields of ADBC Bonds fluctuated slightly. The yield for 3YBonds dropped by 2BPs to 4.32% resulted from the quotation and transaction of170407; referring to the transaction of 170405, the yield for 10Y Bonds keptstable at 4.49%.

Furthermore, the yields for EXIMBC Bonds also waved slightly. The yield of10Y EXIMBC Bonds went down by 2BPs to 4.49% according to the transaction of 170303;20Y Bonds kept stable at 4.64% resulted from the quotation and transaction of 150319.

What’s more, AAA Local Government Bonds on 2Y reached the level of 4.27% causedby market transaction, while the yield for AAA- Bonds on 10Y went to 4.51%according to market price.

Credit Bonds

The yields for credit bonds experienced a small waving today. To be morespecific, the yields of AAA CPamp;Notes on 3M dropped by 4BPs to 4.20%. Theyield of AAA 6M went up by 1BP to 4.43%, and the yield for 1Y also ascended by 5BPsto 4.61%. The yield for 3Y of AAA decreased by 4BPs to 4.85%, while that of AAA5Y Bonds dropped by 2BPs to 4.94%.

The yields for Financial Bonds of Commercial Bank Yield, including CD, presentedmixed pattern focused by funding intense. The spot of Financial Bonds ofCommercial Bank on (AAA 7d/1M/3M/6M/1Y) changed +6BP, -1BP, -4BPs, 0BP and +1BPto 3.49%, 3.88%, 4.74%, 4.66%and 4.72%.

The yields for Urban Construction Bonds experienced small fluctuation. Specifically,the yield of Urban Construction Bonds AAA on 2Y/4Y decreased 1BP and 2BPs to 4.90%and 4.99%. The yields of AA Bonds on 2Y/5Y changed -2BPs and -2BPs to 5.56% and5.77%.

Exchange Market

In addition, there was 4.6 billion of transaction on exchange biddingsystem, which was scale increased than previous. The yields of highly ratedcorporate bonds went up by 1BP; those of corporate bonds and enterprise bondswith middle and low ratings were flat. There was active transaction for 136490today.

(3)Data and Statistics

Macro Economics:the Caixin manufacturing PMI in May was 49.6, down by 0.7 percent thanthat in April, which was the first time that the data dropped below the vicissitudeline for 11 consecutive months.

Foreign Exchange Data: the intermediate value of USD/CNY quotation is 6.8090 today, with CNYincreased by 543BPs, which was the highest level since 10th Novemberof last year.

PBOC:the Central Bank madea series of reverse repurchase of 70 billion Yuan for 7 days and 30 billionYuan for 14 days. There was 100 billion Yuan reverse repurchase due today, andthe Central Bank made a total hedge.

Stock Market:The stock marketsboth went down sharply today. Shanghai composite index dropped to 3102.62 by 14.56points (-0.47%) and Shenzhen component index increased to 9730.33 by 134.52 points(-1.36%). GEM index ascended by 35.24 points (-2.00%) to 1728.49.

郑重声明:此文内容为本网站转载企业宣传资讯,目的在于传播更多信息,与本站立场无关。仅供读者参考,并请自行核实相关内容。